KBFP ACCOUNTANTS IN VAUGHAN, BRANTFORD, BRADFORD & COLLINGWOOD.

KBFP LLP is a Licensed Public Accounting firm of Chartered Professional Accountants in Vaughan, Brantford, Bradford & Collingwood that provides Audits, Review engagements, Corporate tax compliance as well as high level Tax Strategies and cloud accounting to Canadian companies. Our firm has responsive team approach that is well organized and ready to execute what your business needs. The skill sets and knowledge we have as business accountants allow business owners focus on what they do best as we become an extension of your growing company. We will bring your accounting to a virtual level. We will simplify and make you more efficient using the latest cloud based solutions and apps.

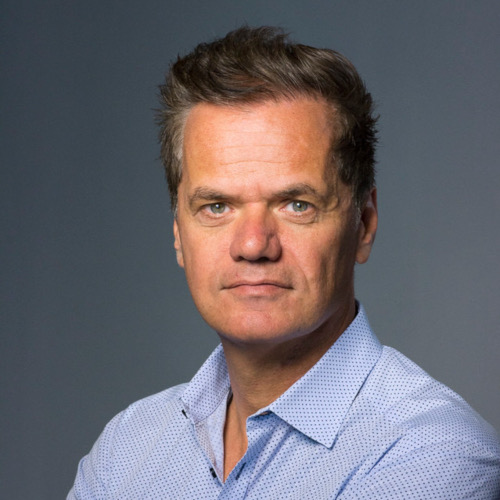

Robert Pellegrino, CPA, CGA

Robert Pellegrino, CPA, CGA